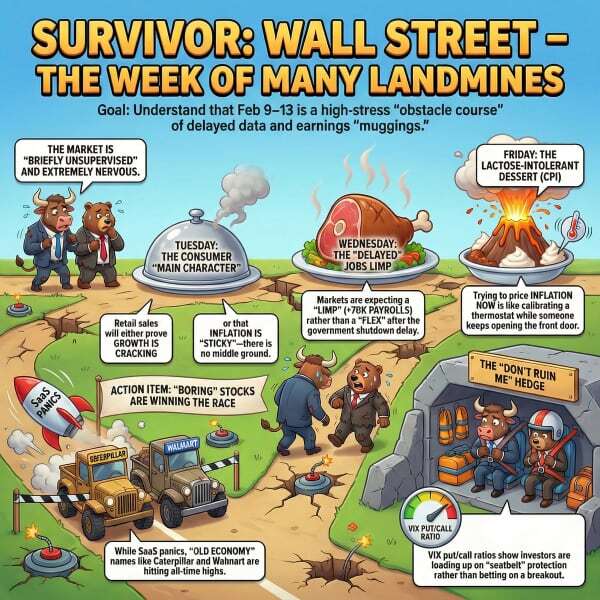

Five Days - Four Landmines - One Market Nervous Breakdown

Market Look-Ahead

Feb 09 to Feb 13

Next week is a forced march. Not a “calendar.” A stress test.

The government shutdown already warped the schedule. Now the market gets to digest delayed Jobs and delayed CPI in the same week, while earnings season keeps throwing bottles from the balcony.

Think about that. The two data points that move everything are landing in a market that is already hedged to the teeth.

Monday: The Setup Day

Monday has no big U.S. macro print on your list. That does not mean “nothing happens.” It means everyone pretends to be calm while quietly loading hedges and rolling options.

If the tape is green on Monday, do not fall in love. That is usually just positioning and bad decision-making with better lighting.

Payroll errors cost more than you think

While many businesses are solving problems at lightspeed, their payroll systems seem to stay stuck in the past. Deel's free Payroll Toolkit shows you what's actually changing in payroll this year, which problems hit first, and how to fix them before they cost you. Because new compliance rules, AI automation, and multi-country remote teams are all colliding at once.

Check out the free Deel Payroll Toolkit today and get a step-by-step roadmap to modernize operations, reduce manual work, and build a payroll strategy that scales with confidence.

Tuesday: Retail Sales

Consumer Reality Check

Tuesday is U.S. Retail Sales. The consumer is still the main character, whether Wall Street likes it or not.

Holiday spending looked strong, at least in the retail monitor data. The question is whether momentum carried into the end of the year or faded the second the credit card bill hit.

Translation: weak retail sales reopen the “growth is cracking” narrative. Strong retail sales reopen the “inflation is sticky” narrative. Pick your poison.

Wednesday: Jobs Report

Delayed, Because Of Course

Wednesday brings the delayed January jobs report. It was pushed back because of the partial government shutdown.

Consensus from S&P Global’s preview is around +70K payrolls with unemployment at 4.4%. CNBC’s framing has it closer to +60K with the same unemployment rate. Either way, nobody is expecting a flex. They are expecting a limp.

If payrolls miss badly, the market stops talking about rate cuts and starts talking about recession odds again. If payrolls beat, yields wake up, and tech gets to relive last week’s trauma.

Friday: CPI

Delayed, Then Weaponized

Friday is the delayed January CPI print. Wall Street consensus is 2.5% YoY headline.

The Cleveland Fed nowcast points to a relatively soft monthly number, which is exactly the kind of data point that can bait traders into overconfidence.

Now add tariffs. Transportation costs. Trade front-loading. The market is trying to price inflation while policy keeps changing the rules mid-game.

Sound familiar? It is like trying to calibrate a thermostat while someone keeps opening the front door.

Earnings

The Week’s Ambush

This is a heavy earnings week. The kind where your watchlist looks like a phone book.

The names that can actually move sentiment are the ones sitting right on the fault lines of this market.

Here is the short list:

$HOOD and $COIN for retail risk appetite and crypto volume.

$SHOP for the “AI eats commerce” narrative and anything tied to online spend.

$CSCO and $AMAT for the real capex truth, not the AI PowerPoint version.

If these print weak guidance, it reinforces the idea that “AI disruption” is not a story. It is a margin event.

The Big Theme

The SaaS Panic Is Still Here

Anthropic’s new tooling hit the market like a brick through a glass conference room. Software names sold off hard, and it spilled into financial data and analytics platforms.

This matters for next week because earnings guidance is where executives either admit the new reality or keep cosplaying 2024.

Think about that the next time someone says, “AI is a tailwind.” Tailwinds do not usually wipe hundreds of billions off a sector in a day.

Markets on the Radar

Not everything is bleeding. Some corners of this market are quietly putting up numbers while the headlines obsess over software carnage and shutdown delays.

Industrials are having a moment. Caterpillar hit $700 last week. New 52-week high. Deere hit a 52-week high. So did Baker Hughes and FedEx. Nine of eleven S&P 500 sectors closed green on Friday, and industrials led the charge alongside energy. This is not noise. This is capital voting with its feet.

The Dow above 50,000 is a rotation headline disguised as a milestone. It tells you old-economy names with real earnings and real dividends are getting repriced higher, while growth stocks argue about margins.

Small and mid-caps are outperforming year-to-date. Russell 2000 up 7.6%. S&P Mid Cap 400 up 8.5%. Nobody is tweeting about it. Which is usually when you should be paying attention.

Memory chips are in short supply. Prices jumped 50% in Q4 2025 and could climb another 40-50% in Q1. That is not a blip. That is a supply chain screaming for capacity that does not exist yet.

Consumer staples keep winning. Walmart crossed $1 trillion. Hershey beat and raised. PepsiCo jumped 5%. Your boring uncle's portfolio is outperforming your options account. Again.

Five Tickers Worth Your Research This Week

These are not recommendations. These are names showing up across momentum screens, analyst upgrades, and sector themes that align with what is actually working in this market. Do your own homework.

1. Celestica ($CLS)

AI infrastructure plays. Revenue guidance just raised to $17 billion for 2026. Q4 EPS of $1.89 crushed estimates. BofA has a $400 target. Barclays rose to $391. The stock is up over 200% in the last 12 months, and earnings revisions are still climbing. If you believe the AI capex cycle is real (and $650 billion says it is), this is a name building the actual plumbing.

2. Caterpillar ($CAT)

The industrial rotation's poster child. New 52-week high at $700+. NVIDIA AI partnership for manufacturing. Oppenheimer target at $700. Bank of America at $708. The AI power story is real here, too. CAT just booked a 2-gigawatt order for natural gas generator sets tied to data center buildouts. This is not your grandfather's Caterpillar. Well, it is. But now it sells to hyperscalers.

3. Micron ($MU)

Up 226% in 120 days. HBM supply for 2026 is sold out. Memory prices are surging. Gross margins are approaching Nvidia's 66% level. The bear case is that the rally is "priced in." The bull case is that memory shortages last through 2028, and capacity cannot catch up. High-conviction, high-beta. Know what you are getting into.

4. Cisco ($CSCO)

Hitting fresh 52-week highs heading into Wednesday earnings. The Splunk acquisition is the wildcard for security revenue. The AI networking partnership with Nvidia is the growth story. Valuation is reasonable relative to mega-cap tech. Dividend yield is real. If you want AI exposure without the nosebleed multiple, this is worth a look.

5. CrowdStrike ($CRWD)

Cybersecurity tends to outperform when markets get nervous about AI disruption. CRWD has a consensus target around $551, roughly 20% above current levels. ARR grew 23% last quarter. In a world where every company is rushing to deploy AI agents, the attack surface just got a lot bigger. Somebody has to secure it. CRWD is the name most analysts point to first.

These five sit across different themes: AI infrastructure (CLS), industrial rotation (CAT), memory supply crunch (MU), enterprise networking (CSCO), and cybersecurity (CRWD). That is not an accident. The market is telling you where money is flowing. The question is whether you are listening or still refreshing your SaaS holdings, hoping for a bounce.

Think about that.

Monday is the calm. Tuesday is the consumer. Wednesday is a labor day. Friday is inflation. Somewhere in there, earnings tries to mug you in broad daylight.

Sentiment: The Hedge Demand Tells The Truth

The VIX put/call ratio jumped sharply on Feb 6. That is not “calm money.” That is “please do not ruin me” money.

Polymarket’s Bitcoin pricing still reads like range-bound hesitation. Plenty of belief in a $70K touch, less conviction in a clean breakout above $75K. That is speculation with a seatbelt on.

Translation: risk appetite exists, but it is not confident. It is cautious, twitchy, and one headline away from flipping the table.

Risk Watch: The If/Then Week

Do not predict. Set conditions. That is how you survive weeks like this.

If Retail Sales disappoint, defensives get another bid and cyclicals look less “smart” and more “late.”

If Jobs comes in weak, the recession narrative gains oxygen again.

If CPI is hot, yields rise, and anything priced on future perfection gets kneecapped.

Also sitting right behind the week is the Supreme Court tariff decision window, which could force massive refunds and reshape the tariff regime. It is not on the Monday-to-Friday calendar, but it is in the market’s peripheral vision.

Retail is going to do what retail always does. Panic on red candles. Victory laps on green ones. Same day. Same hour.

FinTwit will call every move “obvious in hindsight.” Reddit will keep buying “the dip” as if it were a personality trait. You already know this.

The real signal is whether retail shows up in HOOD and COIN numbers, or whether the party moved back to boring stocks with actual cash flow.

Wine & Dine

Next week is a five-course meal served at sprint speed.

Monday is the bread basket. Safe. Suspiciously comforting.

Tuesday is the appetizer, and it is undercooked consumer data.

Wednesday is the main course, and the chef is the BLS, operating short-staffed during a shutdown hangover.

Friday is dessert, and it is CPI. Which is exactly when the market remembers it is lactose intolerant.

Order accordingly.

The Wrap Up

This is not a week to be a hero. It is a week to be deliberate.

Know what you are trading. Know why you are trading it. And do not confuse “a quiet Monday” with “a safe week.”

The market is not stable. It is just briefly unsupervised.

Disclaimer

Tracking the Trade is for informational and entertainment purposes only and does not constitute financial advice. Trading involves substantial risk, including loss of principal. Do your own research and consult a licensed professional before making investment decisions.

If you get chopped up next week, do not blame the calendar. Blame the confidence.

Social Sentiment Snapshot