Last Week's Review

If the stock market were a holiday party, this week was the moment the music died.

Everyone looked around awkwardly at the "unemployment" punch bowl. 4.6%. Four-year high. Uncomfortable silence.

Then Micron kicked the door open with a keg of AI profits.

Party saved.

We started the week worrying that the labor market was freezing over. By Thursday, a "sneakily optimistic" CPI print reminded investors that the AI trade—unlike your New Year's resolutions—is still very much alive.

It was a volatile ride. Ended with a Santa Claus rally.

Bad economic news is only bad until Wall Street figures out how to monetize it. They always do.

Last Week's Market Scorecard

The major indices pulled off a late-week miracle.

Shook off a mid-week slump. Finished primarily in the green. S&P 500 and Nasdaq found their footing thanks to tech.

The bond market? Spent the week nervously side-eyeing the White House's "Battle of the Kevins" for the next Fed Chair. Treated Treasurys less like a safe haven. More like a hot potato.

The Dow hugged the flatline.

The real story was the divergence under the hood: old-school energy stocks drowning in an oil glut. The "AI or Die" cohort split into winners (Micron, Tesla) and losers (Oracle).

Translation: The rising tide is no longer lifting all boats, just the ones with the best GPUs.

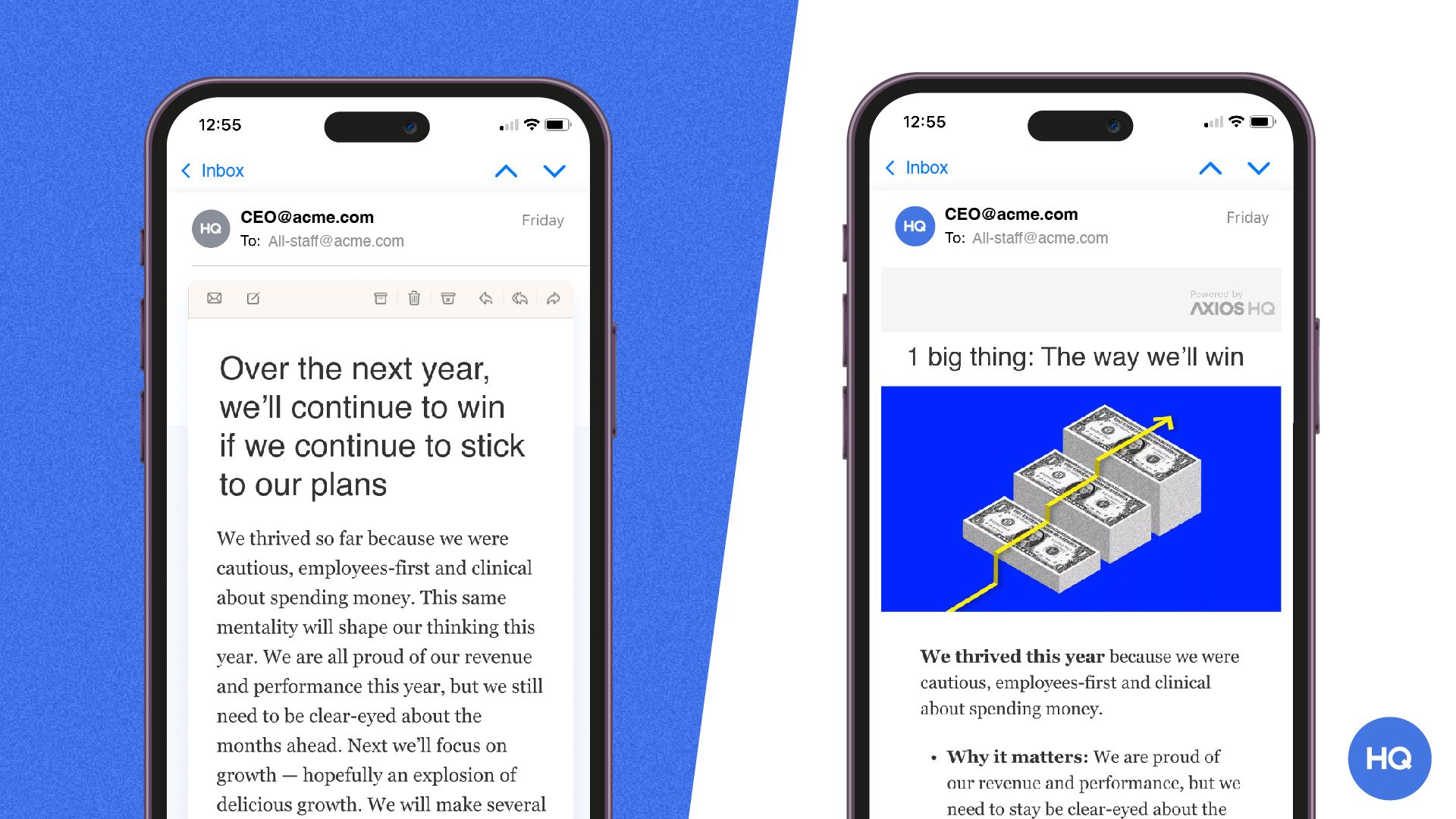

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

Top News From the Past Week

The Tale of Two Kevins

The race to replace Jerome Powell has turned into a reality TV show.

The Apprentice: Federal Reserve Edition.

Two finalists are named Kevin. Both great, apparently.

Betting markets spent the week swinging wildly between Kevin Hassett (the loyalist) and Kevin Warsh (the institutionalist). Trump declared, "I think the two Kevins are great."

Inspiring stuff.

The bond market hates uncertainty almost as much as it hates inflation. Got jittery as traders tried to price in whether we're getting a Fed Chair who fights inflation or one who fights for lower rates at all costs.

Market Implication: The dollar strengthened as FX markets priced in a "Trump Ally" Fed. Long-term yields are holding their breath. If the choice signals a shift away from price stability, expect bonds to throw a tantrum in 2026.

The Great AI Divorce: Oracle vs. Micron

For two years, you could blindly throw a dart at a "tech" stock and make money.

That strategy is officially dead.

Oracle tripped over its own cables. Plunged 5% after a key data center partner pulled out and debt concerns surfaced. Reminder: building the future is expensive.

Meanwhile, Micron delivered a blowout earnings report. Acted like a defibrillator for the sector. Proved that the actual demand for AI memory chips is insatiable.

Here's the shift:

We are entering the "Show Me the Money" phase of the AI trade.

Investors are brutally punishing companies with high capex and low receipts (Oracle) and rewarding the picks-and-shovels providers who are cashing checks today (Micron).

Tesla Takes the Wheel (Literally)

While the rest of the auto industry is retreating into a hybrid shell—Ford even killed the electric F-150 Lightning this week—Tesla is hitting the gas on the robotaxi dream.

Elon Musk confirmed that Tesla is now testing without safety drivers.

Stock soared nearly 4% reclaiming year-long highs.

The divergence is massive:

Legacy auto is admitting defeat on pure EVs due to vanishing tax credits. Tesla is convincing the market it's not a car company. It's a robotics monopoly in the making.

Market Implication: The "Musk Premium" is back. Tesla is decoupling from the broader EV slump. Ford and GM get to fight over the hybrid scraps while Tesla chases a valuation based on autonomous dreams rather than car sales.

Inflation Winks at the Bulls

Thursday's CPI report was the data equivalent of finding a $20 bill in your winter coat.

Unexpected. Delightful.

Headline inflation came in at 2.7% (vs. 3.1% expected). A "sneakily optimistic" print that gave the Fed arguably less reason to be hawkish. Even if they claim to view the data with skepticism due to shutdown noise.

The market didn't care about the skepticism.

Saw the number "2" in front of the inflation rate. Hit the buy button.

Market Implication: This data keeps the dream of a soft landing alive. Fueled the late-week rally. If this trend holds, the "higher for longer" narrative might finally face-plant in Q1 2026.

Upcoming Week Top News

The Holiday Lull (Trap)

Welcome to the shortest, quietest trading week of the year.

Volume will be thinner than the plot of a Hallmark movie. Markets close early on Wednesday. Stay shut on Thursday for Christmas. The algorithmic trading bots will be running the asylum.

The danger here isn't a specific event.

It's the lack of liquidity.

A single stray headline can cause outsized moves when no one is at the desk to absorb the shock.

Market Implication: Don't mistake silence for safety. Low volume means higher volatility potential if any unexpected news drops. Enjoy the eggnog, but keep a stop-loss handy.

Fed Balance Sheet Check

On Tuesday, while you're panic-shopping for last-minute gifts, the Fed will release its weekly balance sheet data (H.4.1).

Sounds boring. But in a week devoid of speeches or meetings, this is the only tea leaf macro traders have to go on.

Any surprise tightening or liquidity drainage could spook the bond market right before the holiday break.

Market Implication: A subtle tightening in reserves could pressure equities slightly. But given the recent dovish tilt, it's likely to be a non-event—unless it isn't. In which case, Merry Chaos.

Current Top Polymarket (Economy Bets)

A snapshot of where the real money is betting on the future.

Kevin Hassett for Fed Chair: 57% — The betting favorite. Representing the "White House Friendly" option.

Kevin Warsh for Fed Chair: 39% — The institutional contender. His odds doubled recently, but he still trails the "loyalist" pick.

No Rate Cut in January: 75% — Despite the cool CPI print, the market is betting the Fed sits on its hands to start 2026.

Bitcoin Year-End Rally: Doubtful — Stuck at $86,000 with "lack of conviction." The crypto bets are fading for a 2025 moonshot.

Gold Watch

Gold and silver are holding steady.

Acting like the designated driver at a rowdy party—boring, but reliable.

Despite the dollar strengthening on "Kevin Hassett" rumors, the precious metals haven't cracked. Maintaining an underlying bullish trend that suggests investors still don't quite trust the fiscal stability of 2026.

Translation: It's a quiet vote of no confidence in the "soft landing" perfection narrative.

Real-Estate Pulse

Home sales ticked up in November.

Defied the gravity of stagnant mortgage rates. Mainly because buyers have finally accepted that "3% rates" are never coming back.

It's a grim acceptance. Like realizing your back will just always hurt a little bit now.

However, with mortgage rates refusing to budge despite Fed cuts, the housing market remains a game of musical chairs where the music stopped three years ago.

Everyone is just standing around awkwardly and waiting for a price drop that isn't coming.

Central Bank & Macro Radar

Date | Event | What to Watch |

|---|---|---|

Tue Dec 23 | Fed Balance Sheet (H.4.1) | Watch for liquidity tightening that could spike repo rates. |

Tue Dec 23 | Bank Assets (H.8) | A check-up on lending health during the holiday spending. |

Wed Dec 24 | Market Early Close | Volume will vanish by noon. Do not trade unless forced. |

Thu Dec 25 | Christmas Day | Markets Closed. Go eat pie. |

Fri Dec 26 | Post-Holiday Open | Likely a zombie session. Good for reviewing 2026 allocations. |

Earnings Watch

Date | Company | Why It Matters |

|---|---|---|

Mon Dec 22 | None | Silence. Enjoy it. |

Tue Dec 23 | None | Seriously, go shopping. |

Wed Dec 24 | None | Markets are closing early. |

Thu Dec 25 | None | Santa is the only one delivering today. |

Fri Dec 26 | None | The corporate world is hungover. |

The timeline is currently a war zone.

"Tesla Bulls" are doing victory laps over Robotaxi videos. "Oracle Bagholders" are wondering where their dividends went.

There's also a simmering, nerdy debate over "OpenAI vs. Nvidia" for company of the year. Feels like arguing whether the engine or the gasoline is more important to the car.

Meanwhile, the general vibe on Main Street remains sour.

Consumer sentiment is down. People are angry about prices.

Lesson: No amount of GDP growth can fix the feeling of paying $18 for a sandwich.

Wine & Dine

This week's market action pairs best with a Spiked Eggnog.

It's mostly sweet and comforting (the CPI print, the Micron rally). But there's enough hidden kick in there (the unemployment rate, the debt concerns) to leave you with a headache if you indulge too much.

Sip it slowly.

Enjoy the sugar high of the Santa Rally. But maybe drink a glass of water before you pass out.

Because the hangover in January might be real.

Wrapping Up

We survived the week of the "Two Kevins" and the "Two AIs."

Emerged with a market that looks surprisingly resilient heading into the holidays.

The tech trade has narrowed. The bond market is nervous. The consumer is grumpy.

But the charts are pointing up. And in this game, price pays.

Enjoy the downtime this week.

Unplug the terminal. Ignore the thin-volume noise. Get ready for 2026.

Because if this week was any indication, the "easy mode" of the bull market is officially over.

Disclaimer

This newsletter is for entertainment and informational purposes only. Does not constitute financial advice.

We are not financial advisors, and our crystal ball is currently in the shop for repairs after failing to predict the Oracle crash.

All investments carry risk, including the risk of losing money, dignity, and holiday cheer.

Please consult a qualified professional before making any financial decisions.

Especially if your strategy involves "YOLOing" into 0DTE options on Christmas Eve.

Social Sentiment Snapshot