Why the Wheel Exists

Why the Wheel Exists (And Why You Should Care)

Most traders lose money not because they're wrong about the market. They lose because they're impatient, because they bet the farm on a single trade, or because they treat their brokerage account like a roulette table after three margaritas. The wheel strategy exists to fix that—not by making you smarter, but by making you more boring.

And boring, it turns out, pays. The wheel isn't a "beat the market" scheme or a get-rich-quick hack. It's a cash-flow system built on three simple principles: probability, time decay, and stocks you actually want to own anyway. That last part is critical—and it's where most people mess this up.

Here's the deal. The wheel works with weekly options because time is your friend, and weekly options decay faster than your New Year's resolutions. More decay means more premium. More premium means more income. More income means you get paid while everyone else is refreshing their portfolio and stress-eating Cheez-Its.

But this strategy isn't for everyone. If the phrase "I got stuck with shares" makes you break out in hives, stop reading now. If you panic when assigned, this isn't your game. And if you're allergic to owning actual shares of actual companies, go buy lottery tickets instead—at least those have fun scratch-off designs.

Payroll errors cost more than you think

While many businesses are solving problems at lightspeed, their payroll systems seem to stay stuck in the past. Deel's free Payroll Toolkit shows you what's actually changing in payroll this year, which problems hit first, and how to fix them before they cost you. Because new compliance rules, AI automation, and multi-country remote teams are all colliding at once.

Check out the free Deel Payroll Toolkit today and get a step-by-step roadmap to modernize operations, reduce manual work, and build a payroll strategy that scales with confidence.

What Is the Wheel Strategy, Anyway?

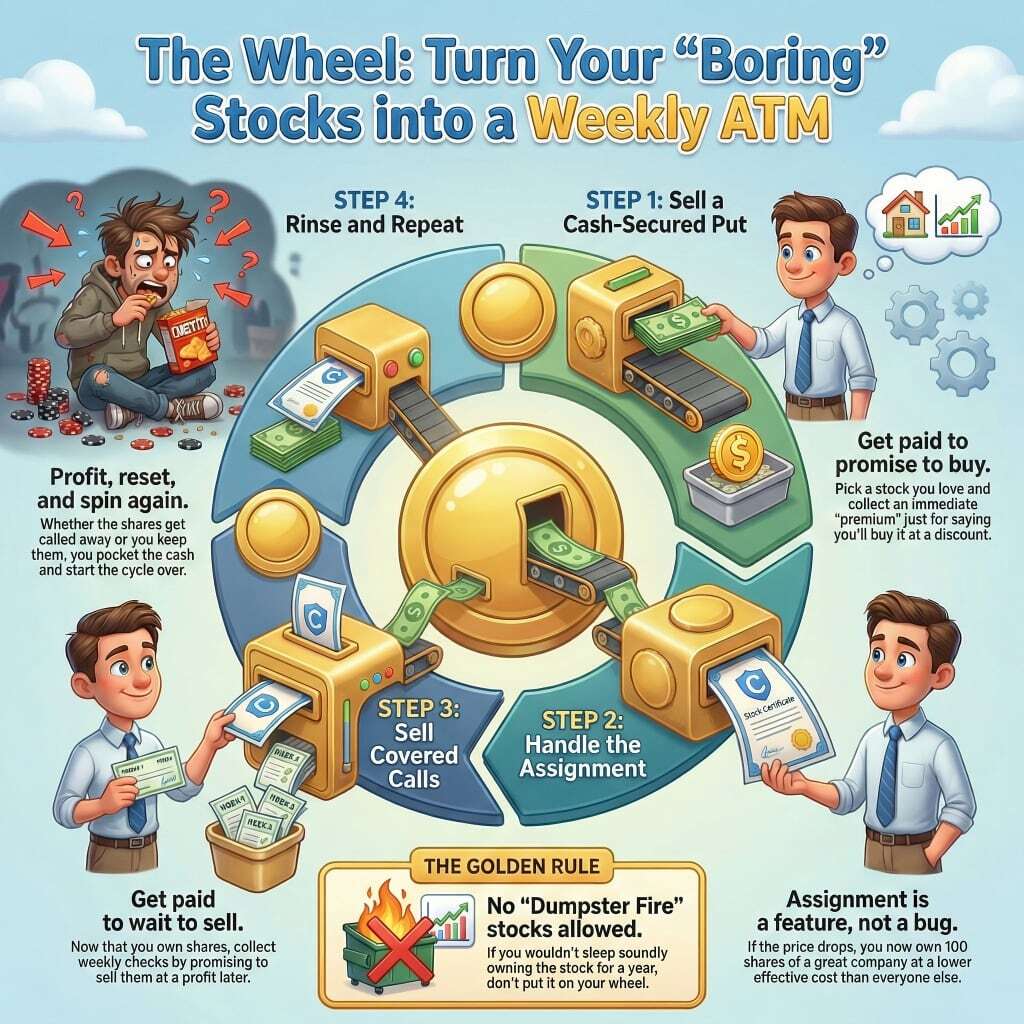

The wheel is simple. That's the beauty of it. There are exactly four steps, and none of them involve praying to the market gods or checking Twitter every eleven seconds.

Step 1: Sell a cash-secured put on a stock you want to own. You pick the strike price, which is basically saying, "I'd happily buy this stock at this price." Someone pays you a premium for that promise. That money hits your account immediately, whether or not anything else happens.

Step 2: If the stock drops below your strike and you get assigned, congratulations—you now own 100 shares. You didn't lose. You made a deal, and the deal happened. Your effective cost basis is lower than the strike price because of the premium you already collected. You're starting ahead.

Step 3: Now that you own shares, sell covered calls against them. Pick a strike above your cost basis, collect more premium, and keep doing this weekly. You're getting paid to wait for the stock to either do nothing, go up a little, or get called away at a profit.

Step 4: Rinse, repeat, collect premium. Whether you keep the shares or they get called away, you made money. Then you start the wheel again with the same stock or a different one.

Let's clarify a few things that confuse people. Cash-secured does not mean naked. You're not out here writing puts with no collateral like some kind of financial daredevil. The cash is sitting in your account, boring and safe, waiting to buy shares if you're assigned. Assignment is not a failure. You didn't "get stuck." You executed the plan. And finally, you are getting paid to wait. That's the whole point. The market doesn't owe you instant gratification, but it will reward you for being patient.

Here's a simple example. Let's say a stock is trading at $50. You sell a weekly put with a strike of $48 and collect $0.70 in premium. Two things can happen. Either the stock stays above $48, in which case the put expires worthless, and you pocket the $70 and move on. Or the stock drops below $48, you get assigned 100 shares, and your effective cost basis is $47.30—not $48. You're already ahead before the stock does anything.

That's the wheel. It's not sexy. It's not a story you'll tell at parties. But it works, and it works because it's built on math, not hope.

Why Use the Wheel Instead of Just Buying 100 Shares?

Good question. If you like a stock and you're going to own it anyway, why not just buy it outright and call it a day? Because you're leaving money on the table.

You Get Paid to Be Patient

When you buy 100 shares, you make zero dollars until the stock moves in your favor. You're sitting there, holding, hoping, refreshing your app, and gaining nothing. With the wheel, you collect premium immediately. Every week. Whether the stock goes up, down, or sideways.

Lower Cost Basis

Premium doesn't just feel good—it reduces your effective entry price. If you sell three weekly puts before getting assigned, you've collected three rounds of premium. That's three discounts stacked on top of each other. Your cost basis keeps dropping, and if the stock does eventually pop, you're making even more because you got in cheaper than everyone who just hit "buy" and hoped for the best.

Defined Decisions

Owning shares forces emotional reactions. The stock dips 5%, and suddenly you're googling "should I sell?" at 2 a.m. Options force structured choices. You picked your strike. You collected your premium. You knew the deal before you entered it. There's no drama, no second-guessing, no emotional tailspin—just execution.

Volatility Is a Feature, Not a Bug

When volatility spikes, most traders freak out. You? You're smiling because high implied volatility means higher premiums. IV crush helps sellers. Choppy markets are good for the wheel. You're not trying to catch a rocket ship—you're just collecting rent while everyone else is losing their minds.

Now, let's be honest about the tradeoff. Yes, you cap your upside. If the stock goes from $50 to $150 in a week, you're not riding that moonshot. You sold a call, it was exercised, you made your profit, and moved on. That's fine. You're trading explosive gains for consistency, and for most people, consistency is what actually builds wealth. Moonshots are fun to talk about. Weekly income pays the bills.

The Only Stocks You Should Wheel

This is where most people go off the rails. They see a stock with juicy premiums and think, "Hell yeah, I'll wheel that." Then they get assigned to some dumpster fire they wouldn't touch with a ten-foot pole, and suddenly the wheel feels like a trap. It's not a trap—you just wheeled the wrong stock.

Here's the rule: You should only wheel stocks you'd buy outright at today's price. If you wouldn't sleep soundly owning 100 shares for the next six to twelve months, don't sell a put on it. Period. This isn't a way to gamble on a bounce or "catch a falling knife." This is income generation on stocks you actually believe in.

Your stock selection checklist: The stock needs liquid weekly options with tight bid-ask spreads, because you're going to be in and out of these positions every week, and you don't want to get hosed on execution. It needs reasonable fundamentals—not perfect, but solid enough that you're not worried about it going to zero. And it absolutely cannot have a binary event risk. No earnings in two days. No FDA decisions. No lawsuits that could torpedo the company overnight.

Red flags? Meme stocks. Anything you "hope bounces." Anything you wouldn't hold through a bad month. If you're crossing your fingers, you're doing it wrong.

If you won't sleep well owning it, don't wheel it. That's the line.

Selling the Put: How to Start the Wheel

Alright, you've picked a stock you'd be happy to own. Now it's time to sell that first put and get this wheel rolling.

Strike Selection

This is part art, part science, and part knowing yourself. Most wheel traders aim for a delta around 20 to 30, which means there's roughly a 20-30% chance the option finishes in the money. That's a decent probability—you're getting paid for taking on risk, but you're not being reckless. You can also pick strikes based on technical levels. If the stock has strong support at $45 and it's trading at $50, selling a $45 put makes sense. You're saying, "If it drops to a level where I'd want to buy anyway, I'm in."

The simplest way to think about strike selection: pick a price where you'd happily buy the stock. Not a price you'd grudgingly accept. Happily. If you'd feel good about that entry, sell the put.

Expiration Choice

Most wheel traders use weeklies, and here's why. Theta decay is fastest in the final week before expiration, which means you're squeezing the most time value out of the shortest period. You also get more decision points. If the market shifts, you're not locked into a 30-day contract—you're in and out in seven days. Faster feedback, faster premium collection, faster iteration.

Position Sizing

Never over-allocate. If you sell a put and get assigned, you need the cash to buy 100 shares. That cash should be sitting in your account, not "available on margin" or "well, I could sell something else." Real cash. Real shares. Real discipline. Multiple smaller wheels beat one oversized wheel. Diversify your setups. Don't put all your premium-hunting in one basket.

What Happens If You Get Assigned?

This is the moment where beginners panic, and it's also the moment where you prove you actually understand the strategy.

Assignment Is Not Failure

You sold a put at a strike you chose, on a stock you wanted to own, at a price you were happy with. The stock dropped that strike, so now you own it. The math didn't change overnight. The thesis didn't break. You didn't "lose"—you transitioned to phase two of the wheel. This is the plan working.

Immediate Actions After Assignment

First, confirm your cost basis. Take the strike price and subtract the premium you collected. That's your real entry point, and it's lower than the strike. Second, ignore the red P/L on your brokerage screen. Seriously. Your broker's app doesn't know you collected a premium. It just sees shares you bought at $48 that are now worth $46 and screams, "YOU'RE DOWN!" You're not. You're in phase two, and you're about to get paid again.

Psychological Reframe

You're now sitting on 100 shares of a stock you wanted to own. Instead of staring at the price and hoping it goes up, you're going to sell covered calls against it and collect premium every single week. You're not waiting for a miracle—you're generating income. That's the shift. You didn't get stuck. You got shares, and now you're getting paid to hold them.

Selling Covered Calls: Phase Two of the Wheel

Now that you own shares, it's time to flip the script and start selling calls. This is where the wheel gets really satisfying, because you're collecting premium on shares you already own. You can't lose them without making a profit.

Call Strike Selection

Pick a strike above your cost basis. Always. You're not here to sell shares at a loss—you're here to sell them at a profit while collecting a premium along the way. You also want to pick a strike above any key resistance levels. If the stock has a history of stalling at $52, don't sell a $51 call unless you're fine getting called away before it tests $52. And pick a strike where you'd be willing to sell. If you'd be heartbroken to lose the shares at $55, don't sell the $55 call. Pick $58 instead.

Weekly Call Management

The beauty of weekly calls is that they expire fast. Let them expire if they're out of the money. Collect the premium and sell another one next week. Rolling is an option, but only roll if you're getting more premium, more time, or a better strike. Don't roll out of fear or because you're emotionally attached. That's how you turn a winning strategy into a mess.

Outcomes

If the call expires worthless, you keep the premium and the shares. Sell another call next week. If the call gets assigned, you sell your shares at a profit, collect the premium, and reset the wheel. You won. Now you can start over with a new put on the same stock or move to something else.

Covered calls turn boredom into income. The stock doesn't have to do anything exciting. You're just sitting there, collecting weekly checks, and letting time do the work.

Managing the Wheel Like You Actually Know What You're Doing

The wheel is simple, but managing it well requires discipline. Here's how to stay sharp.

When to Roll

Only roll for one of three reasons: you're getting more premium, you're buying more time, the math makes sense, or you're moving to a better strike that improves your position. If you're rolling just to avoid assignment because you're scared, stop. That's not strategy—that's emotion. And emotion kills accounts.

When to Take the Loss

Sometimes the thesis breaks. The company reports garbage earnings. The fundamentals shift. The stock starts acting weird. When that happens, close the position and move on. Your capital is better used elsewhere. Don't marry a loser just because you're in the middle of a wheel.

Common Mistakes

Chasing premium is the big one. You see a stock with a fat premium and convince yourself it's fine. It's not fine—it's risky, and that's why the premium is fat. Don't do it. Overtrading is another trap. You don't need to wheel ten stocks at once. You need to wheel two or three really well. And finally, don't wheel trash. Stocks you wouldn't own for a year have no place in this strategy.

Risks, Real Talk, and When the Wheel Breaks

Let's get honest. The wheel isn't bulletproof, and anyone who tells you otherwise is lying or trying to sell you a course.

Risks

Market crashes hurt. If you're holding shares and the market tanks 20%, your shares are down too. You're still collecting premium, but it's not enough to offset a free fall. Prolonged downtrends are rough for the same reason—you're stuck holding shares that keep drifting lower, and even weekly covered calls can't save you from a slow bleed. And then there's opportunity cost. While you're wheeling a stock that's going sideways, maybe there's another stock ripping 40%, and you're missing it. That stings, even if you're making money.

Why This Still Works

Because you're paid to wait. You're not forced to sell at the bottom. You're not panic-trading your way into oblivion. You're generating income while you hold, and if the stock recovers, you're already ahead because of all the premium you collected. You also control the underlying. You picked the stock. You set the strikes. You decided the timeline. That control matters.

The wheel breaks when you break the rules. It breaks when you wheel garbage stocks. It breaks when you over-allocate. It breaks when you panic and start rolling into oblivion because you can't handle holding shares. Follow the rules, and the wheel works. Ignore the rules, and you'll blame the strategy when it was your execution all along.

How This Turns Into a Daily Income System

How This Turns Into a Daily Income System

Here's where this gets practical. The wheel works great when you have a system for picking which stocks to wheel, when to enter, and how to manage your positions. That's exactly what we built.

Every day, you get a list of ten wheel-approved stocks. Not hype stocks. Not lottery tickets. Stocks with liquid options, solid fundamentals, and no binary event risk lurking around the corner. You get suggested put and call strikes, as well as weekly income targets. You get risk notes so you know what you're walking into. You don't get fluff, you don't get YOLO nonsense, and you definitely don't get fake guarantees.

What you do get is a repeatable system for generating weekly income without losing your mind. You're not guessing. You're not hoping. You're executing a proven process on stocks you'd actually want to own. And when the assignment happens, you're not panicking—you're moving to phase two and collecting more premium.

The wheel isn't exciting. It doesn't make for good screenshots or viral tweets. There are no Lambos, diamond hands, or rocket emojis. But it works, and it works because it's boring, disciplined, and built on math instead of hype.

If that sounds like the kind of strategy you'd actually stick with, welcome to the wheel. Let's get to work.

Disclaimer (Because Apparently We Need One)

This is not financial advice. It’s educational content, seasoned with sarcasm and mild emotional damage. Trading options involves risk, uncertainty, and the very real possibility of explaining to your spouse why you now “own shares you didn’t plan on owning.” Past performance is not indicative of future results, especially if you ignore position sizing, panic at assignment, or trade like every week is the Super Bowl. If you attempt the wheel strategy using meme stocks, vibes, or Reddit comments as due diligence, that’s on you. Trade responsibly. Be boring. Let theta do the heavy lifting.